| The

Panamanian Law has been inspired in the former Delaware corporation

legislation, which provides the opportunity to establish offshore companies.

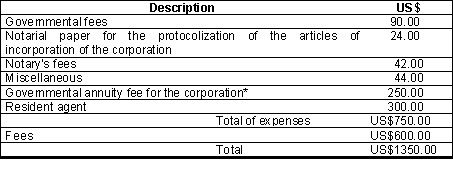

Corporations in Panama are based on an open legislation that provides the owners the possibility to include all kind of provisions and clauses, with the only limitation of the issues expressly included in the Panamanian Law. In addition to the above, the Panamanian offshore company also has the benefit of the tax-free territory, due to the fact that our law provides that the transactions conducted within the territory of the Republic of Panama that has obtained revenue in our country are the only ones subject to the payment of income tax. The basis to incorporate a Panamanian corporation is the following: - Name of the company. For this purpose it will be necessary that you provide us with three different names, in order of preferences, to determine the availability of it before the Public Registry Office. - The corporation must be represented by three (3) different persons that will act as directors. Said persons will be designated as President (normally holds the legal representation of the company), Secretary and Treasurer. The Board of Directors of the company does not need to be shareholders of the corporation. These three (3) directors may be provided by you or your client, or may be provided by our firm. In the event that our firm provides one, two or three directors, it will subject to a charge of US$75.00 per director, yearly. - The normal amount of capital use in a corporation is US$10,000,00, since is the highest amount available by paying the lowest governmental fees for the incorporation of the company. The capital will be divided in shares, which could be issued in the name of the shareholder, or without mentioning any particular name that will result that the holder of the certificate of share will be its owner. Other

option for the capital of the company, in order to pay the minimum governmental

fee, is 500 stocks without a nominal value. |

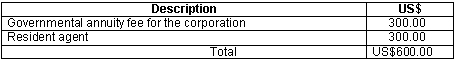

Panamanian

companies are subject of the payment of a governmental annuity fee of

US$250.00, for the first year. The governmental annuity fee since the

second year of constitution will be US$300.00, based on the enactment

of our tax law. Our

law provides that Panamanian corporations must have a local attorney

or local law firm as a Resident Agent, which will represent the company

before the Panamanian governmental authorities. The annual fee for this

purpose is US$150.00.

The charge for directors will also be added, if applicable. Said maintenance fee will apply from the second year of the incorporation of the company. |